Accelerating growth by unleashing the full potential of LendingTree

LendingTree—one of the original fin-tech innovators—upended the way people shopped for loans, bringing a new model that shifted the power from banks to consumers.

This model served LendingTree well for decades, but macro-economic shifts and changing customer expectations revealed the need for a new kind of offering. While the platform boasts 20+ million registered members, there wasn’t a meaningful value proposition to keep those members connected to the brand—and little to differentiate LendingTree from its competitors.

LendingTree engaged Lippincott in an effort to better understand its customers—and develop a product that delivered ongoing, day-to-day value. By cultivating trust in LendingTree’s ability to not only help customers secure credit-based offers, but to also teach them how to be more credit-worthy, we helped create a whole new line of utility and value for both sides of LendingTree’s model: members and lenders. We like to think it was a disruption of the original disruptor.

Research & customer insights

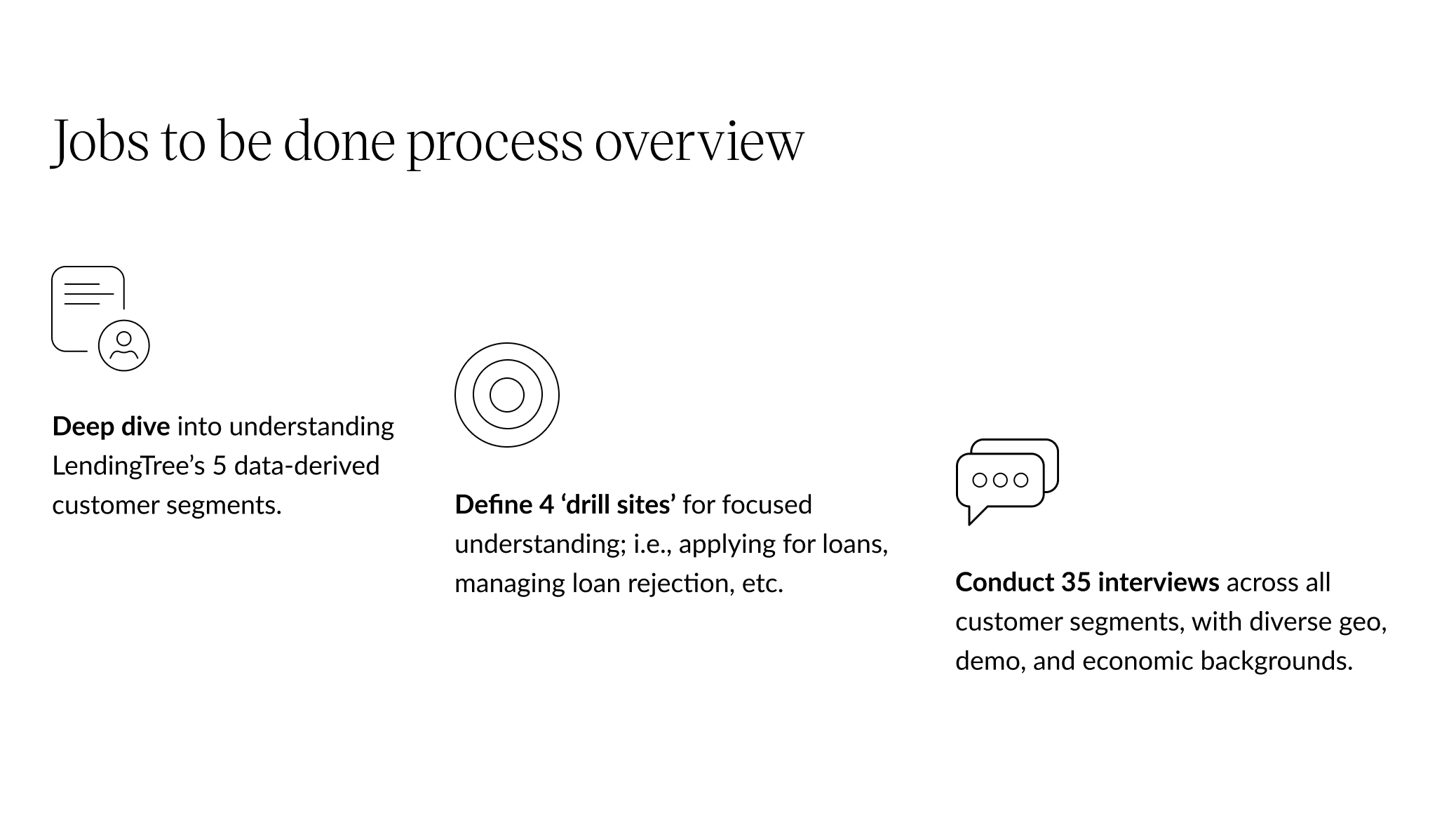

LendingTree leadership sought to drive growth by shifting the organization’s focus from features that drive transactions to experiences that build trust with the end user. We leaned deep into our Jobs-to-be-Done methodology, interviewing dozens of loan shoppers nationwide to understand how they think about their credit and what it takes to earn their trust when it comes to their finances.

We learned that while credit plays an important—albeit divisive—role in people’s lives, the actual credit score numbers did little to paint a holistic picture of where they were in their financial journey. A much more holistic and human-centered approach to understanding people was required to enable progress—one that accounted for their individual circumstances, mindsets, and behaviors. Only when we demonstrate this kind of understanding will people be open to financial help. Even then, however, they didn’t want an advisor; rather, they wanted a supportive ally to teach and empower them to make their own informed financial decisions.

“We’re great at maintaining products but what we need help with is building new ones—in an impactful, scalable and customer-centric way.”

Experience strategy & design sprint

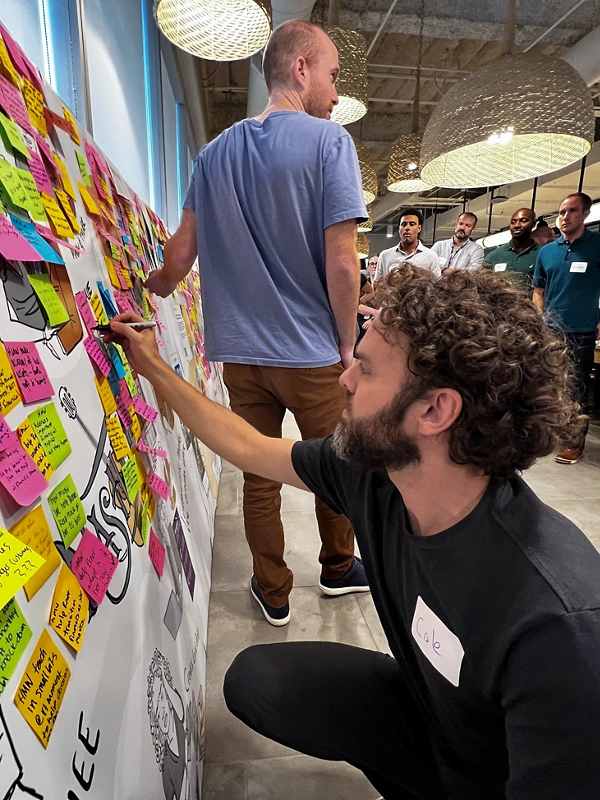

With deep customer insights in tow, we kicked off our Living Ideas sprint—an immersive and collaborative design thinking process that translates customer empathy into experience opportunities, designed to come to life and evolve within the context of our customer’s lives.

Over multiple days, we brought a large and diverse team of LendingTree employees into the nuances of their customers’ lives and the best practices of experience disruptors. We turned hundreds of How Might We…? provocations into a collection of experience briefs—and ultimately into a tight suite of concepts for further development.

The experience ecosystem

Our Living Ideas sprint yielded nine testable product propositions. Through an iterative process of consumer testing and refinement, we landed on an experience anchored in one core idea: a lending and financial health ally that weaves LendingTree legacy products, new offerings, and a growing array of partnerships together into a service—purpose-built to deliver on the financial needs of those seeking help.

We illustrated this ecosystem in a high-fidelity experience map through the point-of-view of their customer archetype, articulating the contextual benefit to the end user. Simultaneously, we developed wireframes introducing the user experience, tech and data requirements for implementation, and content opportunities.

“Spring is a financial ally for people who have big goals and need a plan to reach them. Everything from the content to code was purpose-built to bring that experience to life.”

Bringing the “Ally” to life

The Living Line is the manifestation of our brand character, guiding our members through the experience so that they feel supported, motivated, and empowered to make financial progress. Purposeful, confident, and charming, our Living Line punches through the user experience and appears in key moments to provide insight and clarification. It’s our way of showing up to guide members one step at a time.

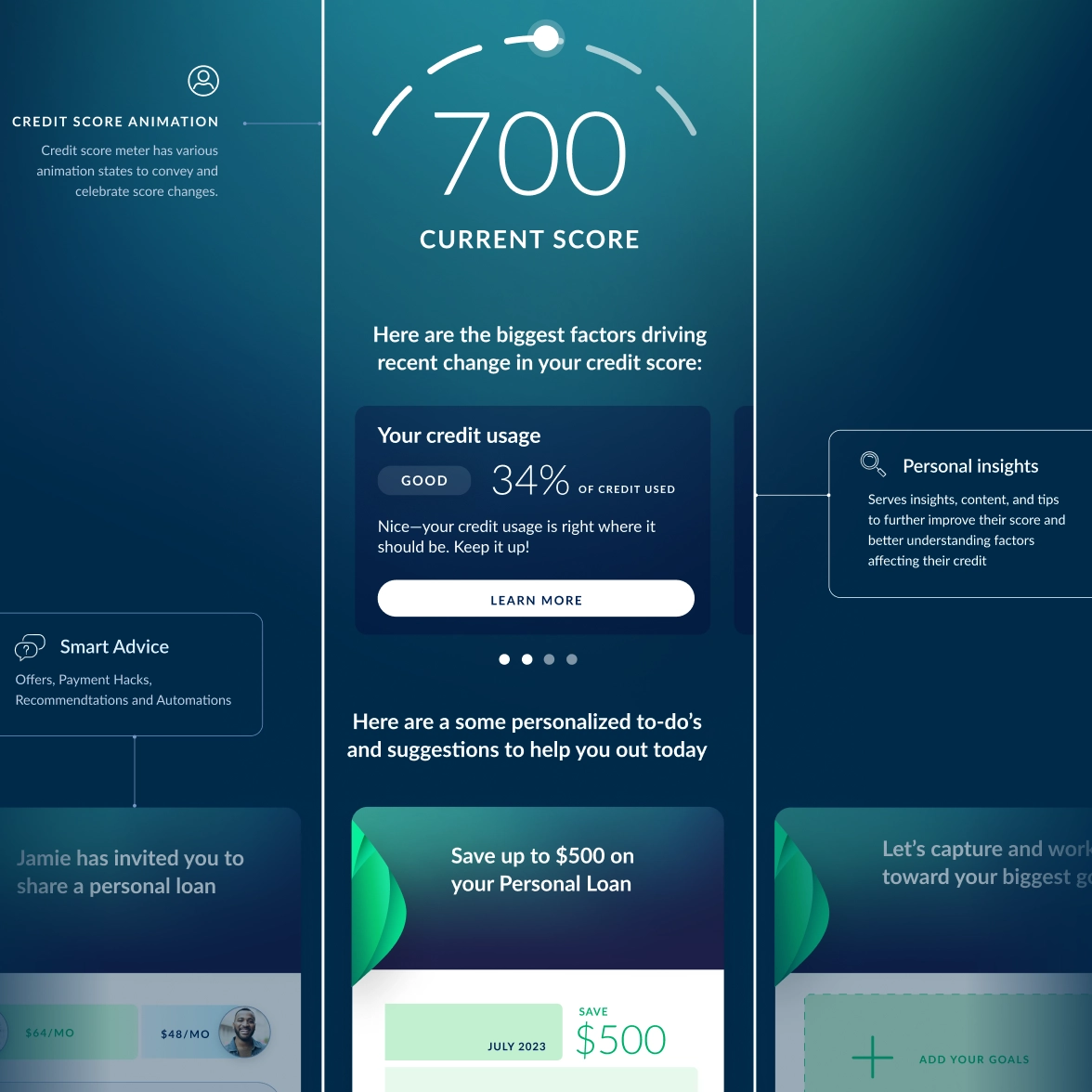

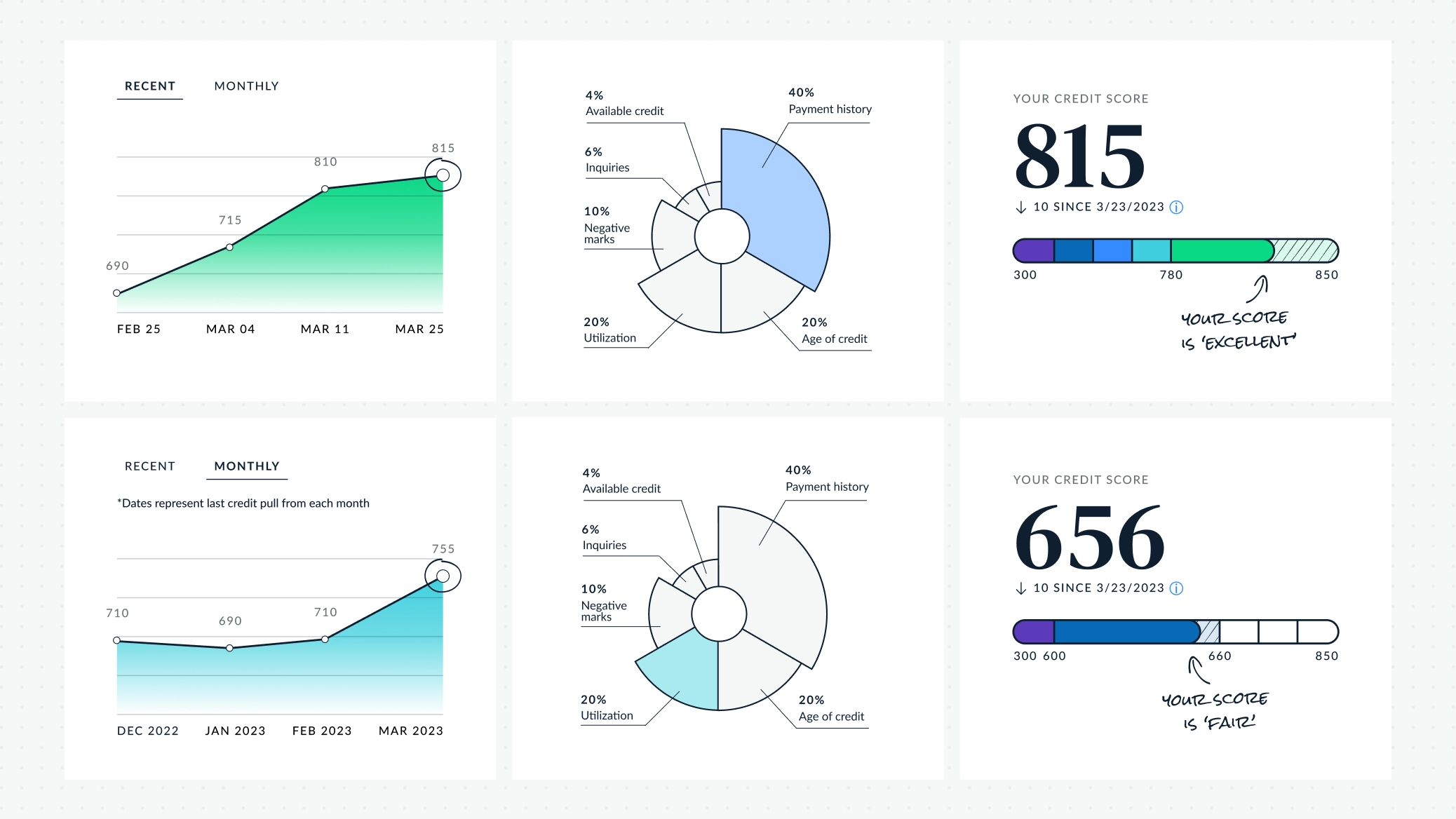

Experience spotlight: Credit Score

The primary motivator for member engagement starts with the credit score. Understanding the long game of credit improvement and the value of incremental gains, we designed infographics and animated interactions to emphasize customer progress. Beyond the numbers, we crafted the experience to support customers’ desire to understand the why? behind their number, including both personal insights and industry standards.

Experience spotlight: Recommendation Loop

Personalized recommendation cards are the main driver of the Spring experience. Personalizing content requires strategic design and an understanding of the nuance of user delivery, as well as simultaneous storytelling. The result is seen in the Recommendation Cards, which are robust and intentional throughout the experience.

Design system

The Spring visual system grew out of LendingTree’s core brand, with a fresh infusion of lush, vibrant colors and the aesthetic treatment of the Living Line inspiring everything from infographics to illustrations. Working closely with LendingTree’s design team, we delivered robust guidelines and component libraries that were ready for immediate implementation and deployment.

“Lippincott didn’t just learn about our customers, they taught us how to bring the voice of the customer into our day-to-day. Our product team has never had more clarity on what features and offerings matter most.”

Collaborative process

Making every moment feel just right takes a team effort between Design and Creative Technology—and our relationship with LendingTree was nothing less than full-stack.

Creating a consumer financial offering of this scope required ample system architecture work. We detailed out the multiple sources of data across many current and legacy systems, investigated how we could power new features, and designed mechanics for combining it all to give customers actionable financial insights tailored specifically to their circumstances.

We embedded with LendingTree’s product and tech teams from beginning to end. Daily collaboration—on everything from technical design and compression of animated UI assets to data-backed algorithms— was paramount to getting Spring launched.