Looking Vertically

Seven ways payment brands can break through

Think about the last time you bought something: a cup of coffee with the tap of your phone, a food delivery ordered via mobile app, or a retail purchase online. Chances are that you can’t recall the payment platform that processed the transaction—and even if you could, you might just shrug.

It’s hard to believe that at one time we only had three forms of payment: credit cards, checks, and cash. Now we have multiple payment options at any given time, but the payment landscape is a vast ecosystem that’s a bit like Grand Central Station at rush hour: crowded and overwhelming to navigate.

So what does success look like for a payment brand? Amid dozens of other brands offering similar services and functionality, is true differentiation even possible?

With an array of popular payment types such as Apple Pay, Google Pay, Amazon Pay, and other digital and mobile pay services, cash hasn’t been king for a long time—yet no payment brand has risen to become the clear winner, either. Functionalities have begun to overlap, putting brands at risk for being commoditized (at this point, solid functionality gets a brand to parity—not exceptionalism).

Like it or not, it’s more difficult, and more critical, than ever for payment brands to stand out.

Because consumers now have an astonishing array of choices for any given purchase, expectations are higher than ever, and loyalty is harder for brands to win and retain. Plus, many consumers look for authenticity and personalization in their interactions with brands; those that offer a sense of genuine engagement are likely to stand apart from the pack.

Interacting with digital payment platforms is nobody’s idea of a warm hug, so how do payment brands cultivate brand loyalty and affection? It starts with a bit of creativity.

Think about Venmo, a brand that launched in 2009 when the founders wanted a way to pay each other for things without using cash or writing a check. Venmo proved groundbreaking when it first appeared and it remains a popular favorite, despite emerging competitors.

How has the brand sustained its relevance? Perhaps one reason is Venmo’s social feed, which allows consumers to make casual, peer-to-peer transactions, and to make their transactions—which include descriptive explanations—visible to friends. The social sharing capability cultivates connections beyond just facilitating payments. Venmo has leaned into this idea of fostering connection with the addition of gift cards in 2023.

It didn’t seem so long ago that brick-and-mortar financial institutions (including legacy banks), were central to everyday life as we managed our finances, deposited paychecks, built up savings, and more. Even if we had relationships with more than one bank, the product lines were clearly drawn: you might have a mortgage with one bank, for instance, and your retirement account with another.

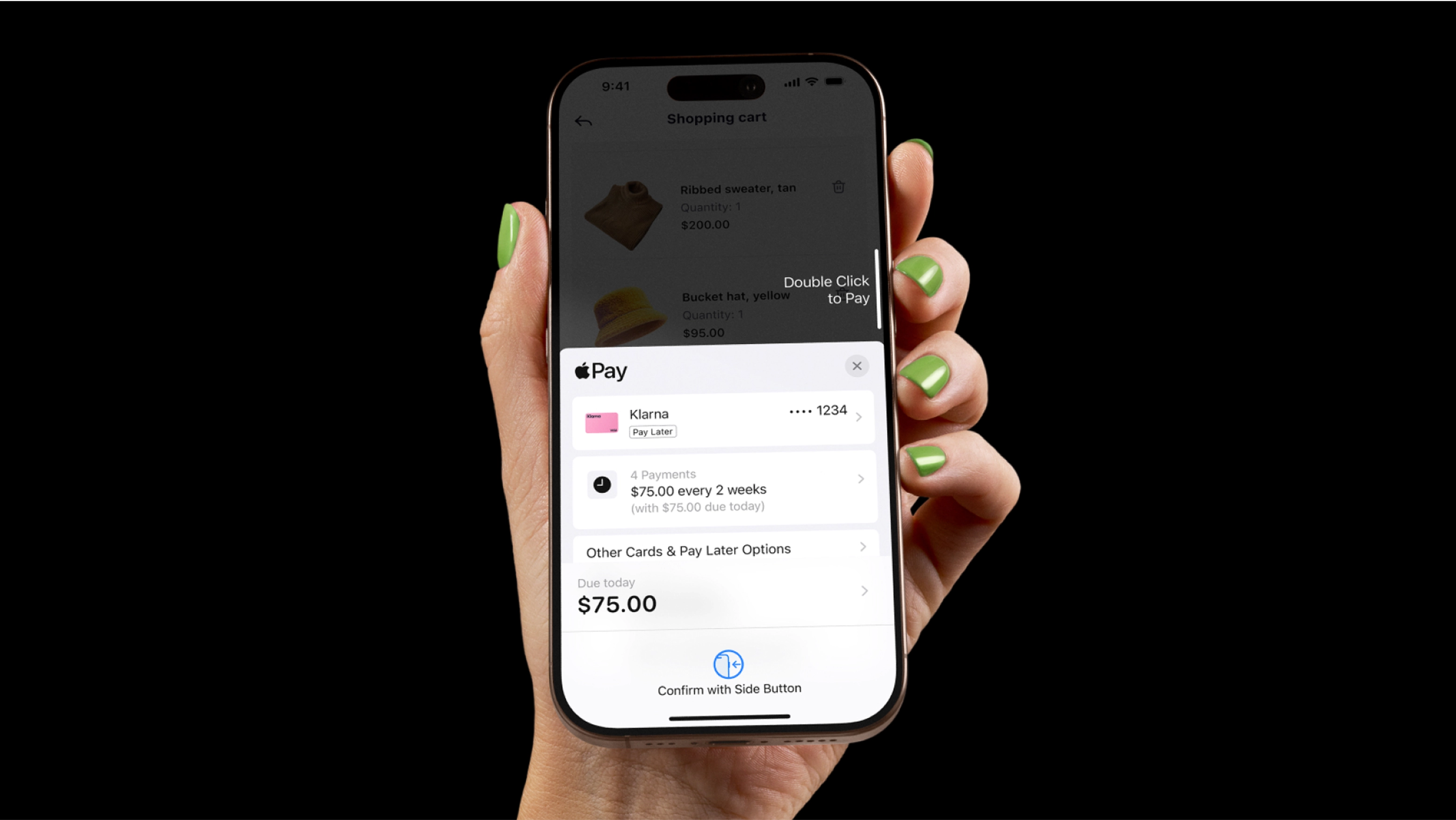

For modern payment brands, survival now demands making competitors’ products part of your ecosystem to provide consumers with a seamless experience. To maximize reach, the payments ecosystem has evolved into what you might call a “coop-etition”: brands are both cooperating (however reluctantly) and competing (quite fiercely) for consumer attention and wallet share. Considering this system of coop-etition, perhaps the best response is not to resist but to own and embrace it.

Payment providers are now “everything, everywhere, all at once” in an effort to play any role—whether lead or supporting—in consumers’ daily transactions, no matter where. Yet by playing nice with the “coop-etition,” it’s more challenging for a single provider to come out on top.

The truth is that 0 of 30 payment brands are seen as “unique” by the majority of people who use them, according to a 2024 Lippincott survey. The lack of distinction leaves each brand in the game, but to what end?

Let’s take a deeper look at how core brand practices are playing out within the category.

With a small amount of visual real estate to work with, brand names have to try harder these days to attract attention and sustain consumer preference. In the payments space, there are two primary naming conventions, with brands leaning into the type that’s right for them.

First are descriptive names tied to a widely recognizable master brand, so as to leverage existing brand equity—think Apple Pay, Google Pay, Amazon Pay, or Meta Pay, for example.

The second naming convention involves real or invented words intended to draw attention to a particular functionality—think Venmo, Stripe, and Afterpay.

Working within these naming conventions has worked up to a point, yet it’s tough (if not impossible) to differentiate on name alone. That’s why a brand name is just one critical element on the path toward differentiation.

We’ve all grown accustomed to lookalike messaging around digital payment experiences: they’re touted as easy, trustworthy, reliable, and secure. While these descriptions may indeed be true in terms of features, functionality, and experience, they don’t necessarily ring more (or less) true for any particular brand. Or, if they do, few people are aware of key differences or benefits. “The messaging to describe one brand seems to fit just as easily with another: swap out “helpful” for American Express and it works just as nicely for Capital One.

There are similar sets of features and benefits, which doesn’t necessarily help consumers feel seen or valued on an individual level. Even though 73% of people express a desire for payment brands to understand and meet their evolving preferences, they report that only 39% of these brands deliver on making them feel understood. There’s plenty of work to be done by payment brands in this regard, which might involve taking more risks to rise above a sea of sameness.

“The truth is that 0 of 30 payment brands are seen as ‘unique’ by the majority of people who use them. The lack of distinction leaves each brand in the game, but to what end?”

When it comes to design, legacy players such as Visa and American Express have traditionally taken a more understated approach—repurposing their existing design toolkit; using messaging with an instructional tone that prioritizes convenience and security; and using familiar imagery and graphic elements. Although maintaining the status quo may satisfy customer retention goals, it might not boost customer acquisition or build brand awareness with a new demographic.

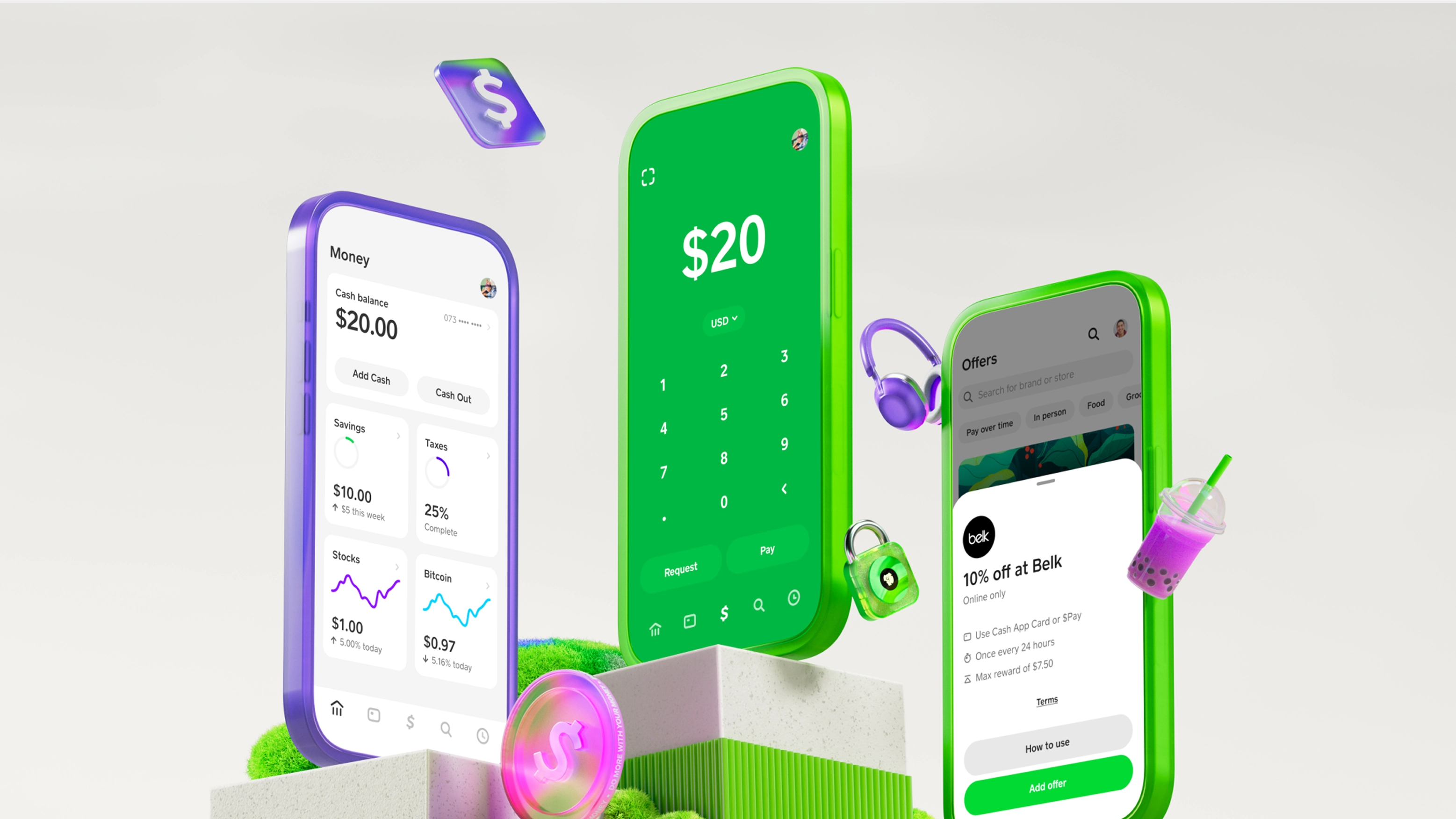

Digital native brands such as Apple Pay, Venmo, PayPal, Zelle, and Paze are starting to push the boundaries of how a payment brand comes to life:

- Websites are dynamic and brand-immersive, using motion and parallax scrolling to create a captivating experience

- Voice flexes between a straightforward tone and a relatable, friendly, playful approach (“What’s Zelle? Glad you asked!”)

- Unique graphics, diverse color palettes, and modern photography are used to stand out and connect with customers on an emotional level

This is a bolder approach, to be sure, but digital natives are still competing fiercely to stand out within a pack of other digital natives—some with greater name recognition than others.

For payment brands to cultivate meaningful, long-lasting relationships with consumers and ensure long-term success, we know they have to differentiate in multiple ways. How can they get there?

No worries: we’ve come up with seven key principles to help brands build a stronger and more distinctive presence in the daily lives of consumers

As we’ve stated, it’s no longer enough to claim to be the fastest, most secure, or most convenient option, even if you are. To keep people coming back, payment brands must find creative ways to go beyond functional transactions, and connect more broadly—and authentically—with people’s lives and the things they care about.

As we’ve stated, it’s no longer enough to claim to be the fastest, most secure, or most convenient option, even if you are. To keep people coming back, payment brands must find creative ways to go beyond functional transactions, and connect more broadly—and authentically—with people’s lives and the things they care about.

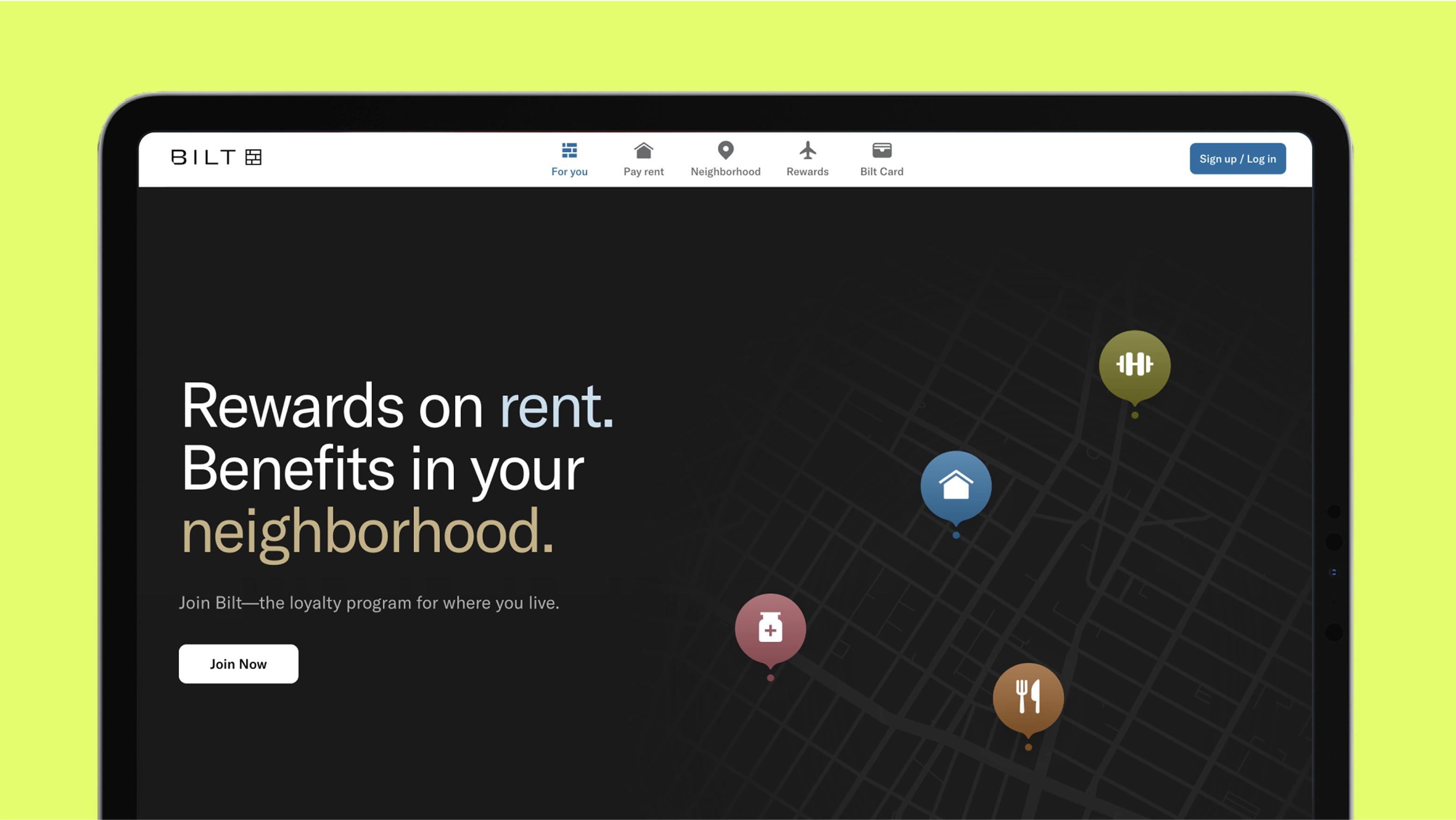

To the consumer, there’s not much differentiation around the technology we use to make payments. Instead of competing over the transaction, brands can flip the script by centering their core value proposition beyond the payment, and play a larger role in people’s lives.

Most payment brands offer some form of cash back or discounts. Avoid a costly fight to the bottom for who can provide the “best” benefits. Instead, create more staying power with a rewards program that bolsters and enhances other aspects of your core value proposition.

Transactions are often fleeting; with limited time and visual real estate to leave a lasting impression, brands must get creative in reinforcing their presence. Aim to create signature moments—such as an interaction, a sound, a haptic—to elevate customer experience and provide moments of surprise and delight in unexpected places.

Payment brands have a unique ability to understand customers through detailed insights into their purchasing behaviors and patterns. All brands use data to deliver some form of personalization. To remain distinct, however, brands must embrace hyper-personalization. That means using data to deliver unique experiences that feel relevant both in the context of their brand, and the reason customers turn to them. For example, a brand might offer financial wellness tools, integrating features that help consumers manage finances, track spending, and achieve financial goals.

As payments go increasingly digital and apps play a bigger role in people’s everyday lifestyles, brands have the opportunity to create a unique design perspective and brand voice. Thinking outside the box can open up exciting design and messaging choices to help brands lead the pack.

Thank you!

If the download does not start automatically, please click here